Financial management applications. The best programs for home accounting. Family Budget Lite

It is often difficult to monitor the flow of money within a family. You should always calculate how much to put aside for renting an apartment, for example, or for paying utilities. What part of the budget should be allocated for food, for new clothes, or how much can be set aside for gifts for friends, without subsequent financial difficulties.

It is necessary to control the family budget due to variable earnings and expenses. After all, psychologists say that because of money issues, family relationships often deteriorate greatly and all idylls collapse.

For less hassle with a variety of papers and notebooks, you can purchase or download for free any program for maintaining a family budget. Wherein

- you will be able to completely control your family’s wallet, and you will not have financial difficulties due to incorrect calculation of the necessary funds;

- you will have before your eyes all the sources of budget replenishment: salaries, bonuses, gifts, etc.;

- it will be possible to more thoughtfully control expenses from your home bank;

- financial software can help you save a lot.

And then the question becomes which program is better. Let's consider several options at once.

Which program to choose?

« Home accounting». This program accounting is distinguished by its simplicity and the presence of the most necessary functions, such as: accounting for profit and loss, debts, payment planning, control over accounts and even exchange rates. By using this program, you can forget about the financial headache, although this method Budgeting is paid - 500 rubles.

« Money Tracker" In fact, the program is quite well thought out for accounting, it is convenient to use, but you will have to get used to it a little. Most people note multifunctionality as a minus, because without studying the utility, many things may seem simply useless and interfere with the direct accounting process.

But there is a small trick to this program. You will have the opportunity to control price changes in stores and forecast your budget for several months or a year. The utility can evaluate how much you spend; if the green indicator is on, it means that your family treasure is in perfect order and you are managing your finances correctly.

Yellow means that in some places it is worth reducing the level of spending. Red warns that in this way you can waste all your money recklessly.

« Family 10"is a program that will immediately set you up for a friendly attitude. The main advantage is the simplicity and clarity of wallet management. There are no abstruse terms or incomprehensible functions here. Everything is shown and written in accessible human language. You will have the opportunity to keep track of absolutely any item in the house.

You will be able to record and then play back information about its price, place of purchase, warranty period and anything else that interests you. You'll be allowed to budget for free for the first 30 days, but will then be required to pay between $10 and $20.

« AceMoney" So, let’s immediately note that this utility for monitoring income and expenses will cost you 500 rubles (there are also free version, but only one account is available, which causes inconvenience). The only negative is that there is no separation of expenses and income, but there is one single operation - a transaction. Now let's look at the advantages:

- thanks to AceMoney, it will be possible to account for shares and securities. For this purpose, it has a corresponding section “Promotions”;

- There are already template categories into which you can distribute your expenses. For example, payment for cable, electricity, food, etc. You don't have to create them yourself;

- You can manage not only your family accounts, but also monitor your bank accounts. You can see which account is in which bank, at what interest rates, and so on.

« DomFin"is a program that has a primitive interface with clearly defined and specific functions for successfully managing a shared wallet. The utility is absolutely free. It clearly explains where to write down the list of income and in which column to count the minus. The utility is intuitive to use and will not make you think long about the mechanism of action.

Conclusion

E if you want to get the effect of a specialized software and income control, you must clearly understand what you want to achieve in the end. If any points in saving and planning are unclear to you, then it is better to clarify them immediately - this will yield sweet fruit.

As a conclusion, we can say that the program should be selected based on family characteristics, because some simply do not need to account for shares and securities. Choose the accounting method that will be as clear and accessible to you as possible.

Maintaining home accounting is a guarantee of maintaining wealth in families. Users can control their finances both the old fashioned way, that is, in notebooks, and in modern ways, by installing appropriate applications on their computers. In this review, the best program for tracking income and expenses will be selected.

HomeBank

A free utility that allows you to do home accounting. With this, the user can control the family budget, analyze expenses, etc. The application allows you to import data from the Quicken service and utilities for managing personal funds. The program for accounting income and expenses works with QIF, QFX, CSV and OFX formats.

Incoming transactions are automatically added to the database. The user can enter tags and edit several lines at the same time. This will speed up the work and simplify the settlement process. The application allows you to create an annual or monthly plan for each category, as well as generate dynamic reporting that reflects your current financial situation. For clarity, diagrams are added to the text.

"Family Budget Lite"

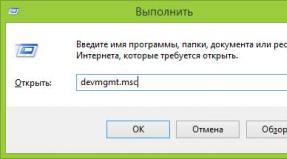

In order to get started with this program, you just need to indicate your income and expenses in the appropriate columns. All operations are performed automatically. Data is reported in several main categories. In the program, you can keep monthly records of loans, deposits, etc. When specifying the names of goods, the application automatically selects the required category from the list.

To create a detailed report, you need to make 1 click with the computer mouse. The program works with HTML, BMP, TXT formats, as well as MS Word and Excel. If necessary, you can print and save the document. Each user who wants to work with the utility needs to register. The password can be set when starting the program.

Searching for invoices is very convenient. The user can customize the issue using several filters: “product”, “date”, etc.

"Family Accounting"

The utility allows you to analyze and control income. The user will learn to plan expenses and think through a budget. He will no longer have to remember where the funds set aside for an important purchase went. The program allows you to keep records of revenue and debts in various currencies and analyze financial transactions.

The user can not only work in the application independently, but also provide access to other people. Each participant in the system will have their own credentials. The program for recording income and expenses creates archival copies of the database, which are saved for later restoration or export to Excel.

CashFly

This is a simple and very user-friendly utility. The PC owner can create visual, multi-level structures and complex graphs that display input data and other important financial information. Here the user will find an address book, a list of companies and a personal diary.

The organizer allows you to save notes about important events. The utility was created to keep track of income in any currency, carry out planned operations and print information. To restrict access to the database, the user must set a password.

"Home Accounting Lite"

This utility is designed for daily accounting of incoming funds. The user can systematize personal and family expenses. The application will also appeal to owners of small firms and enterprises. The interface of the program for accounting income and expenses of individual entrepreneurs is simple and understandable. To work with the utility, it is not necessary to have special knowledge in the field of accounting.

The user can take into account income, expenses and other transactions. There is no limit on the number of accounts in the program. The user can select a currency, adjust the interface to suit their own needs, and look for answers to questions in a special help system. To start working with the application, you must enter your login and password.

AbilityCash

Using this application, you can keep financial records both at home and in an organization. The user has access to a large number of options. Wherein demon paid program accounting for expenses and income does not take up much space on your PC. The utility's interface is quite simple. Thanks to this, the application can be used without special knowledge and skills.

The program allows you to adapt any function. The user can keep separate records for each item of personal expenses. He does not have to enter data into the proposed category. Accounting for incoming funds is carried out in any currency.

Using this utility, you can create a plan for cash receipts and expenses for any period. The program helps you accumulate the required amount of money within a specified time frame.

Personal Finances

Another convenient app for managing money. The developers invite users to download trial version income and expense accounting programs for free or purchase a license. The utility has a user-friendly interface. Using the demo base, you can master the program in short time. The application allows you to control the expenses of all family members, track bank deposits and loan payments, and plan a budget in different currencies.

The user can transfer money from one account to another, view a list of debts, and create reports on selected categories. The utility was created for operating systems Windows systems and iOS. The application can also be launched from a USB drive.

Family Pro 11

This is another paid program for tracking income and expenses for the home. The developers offer PC owners to download a trial version of the utility. This is necessary so that the user has the opportunity to explore all the options and understand whether he will purchase a license. The interface is convenient and clear. The application can be mastered in a few hours.

A program for tracking income and expenses allows you to track loan payments, create goals, and plan a family budget. The user can save reports for a specified period and synchronize with other devices. The disadvantages of the utility include the lack of an option to add categories.

Keeping a book of income and expenses in the program is very convenient. To store data, just install the utility. After this, the PC owner can begin to make calculations, while simultaneously systematizing income and other financial transactions.

conclusions

Users who want to work with a full-featured utility will appreciate the HomeBank and CashFly applications. The Family Pro 11 program will be chosen by people who know how to succinctly manage a family budget.

Guys, we put our soul into the site. Thank you for that

that you are discovering this beauty. Thanks for the inspiration and goosebumps.

Join us on Facebook And In contact with

To protect yourself from big expenses and save up for a small house somewhere on the seashore, you don’t have to deny yourself everything and tightly sew your savings into a mattress. Sometimes it's enough to just use personal assistants, which fit into a regular smartphone. website collected 10 applications for saving, counting and increasing your income.

Zen mani

A convenient tool for budget planning with recognition of SMS from all the largest banks in Russia, Ukraine, Belarus and automatic creation operations. You can work on several devices - the data will be automatically synchronized. In addition, the program analyzes costs and makes forecasts. It's quite easy to understand here.

CoinKeeper

Very convenient for quickly recording expenses directly at the checkout. The main screen of the application looks like a large coin holder. Income, wallets and expenses are presented as stacks. To record a waste, simply move a coin from one stack to another. In addition, the application analyzes income and expenses for different periods, helps make forecasts and has many other useful functions.

Rubbishmoney

The application contains 4 laconic directories: expenses, income, movements and exchange. You can make a shopping list and then audit it: what was bought, what was not, how much was spent. The application allows you to create both short-term and long-term budgets. You can plan to buy, say, a sofa, and the “Drebemoney” will diligently count how much is left to save. The application has a multi-user mode - you can connect all family members to the system and monitor the overall budget.

Spendee

The application has fairly minimalist functionality, so adding a purchase to the database will take no more than a couple of seconds. Those who are strong in spirit can take a look at the expense statistics section. After this, many are guaranteed to begin to refrain from unnecessary little things that they usually grabbed from display cases without thinking.

Toshl is quite similar in functionality to Spendee and, rather, is its eye-pleasing alternative, since you will be keeping track of expenses under the supervision of cute cartoons of Asian origin. The downside: you can’t specify multiple accounts, but you can separate them with tags.

Daily Budget

If you want to start saving money for something more meaningful than lunch, this app will help you take control and calculate your daily expenses. First, you need to enter your monthly income, indicate the amount of standard monthly expenses (for example, utility bills) and indicate the percentage of your total income that you want to put into the piggy bank. After a little thought, the application will give you an amount that you can safely spend during the day.

HomeMoney

A convenient and widely appreciated application for home accounting. Allows you to record expenses, income, transfers from account to account, and evaluate account balances. It is possible to view the entered information in the form of graphs - and it immediately becomes clear where the holes are in the budget.

M8 - my money. My way

If you are one of those who, when buying some trinket, naively thinks that a couple of hundred rubles will not affect your budget at all, m8 will tactfully hint to the contrary. By entering every purchase here, you will find out which area of life costs you the most, and you will also understand that all the minor expenses add up to a large figure that would be enough, for example, to go on vacation.

To protect yourself from major expenses and save up for a small house in a European province, you don’t have to deny yourself everything and sew your savings tightly into your socks. By installing EasyCost, you can achieve more: for example, save for a one-room apartment. To do this, you just need to indicate the amount of your income and note your expenses every day. All expenses can be divided into several cards: work, family, travel, and so on. This application is not without its shortcomings and has an extremely high entry barrier for beginners, but if you manage to figure it out, you will get a convenient financial planner.

No registration or Internet access is required to use.

It is possible to select icons for manually created expense categories.

Overloaded, not friendly to beginners and completely unobvious functionality with a bunch of incomprehensible buttons.

Getting to know new functions happens completely by accident, as a result of pixel hunting across the screen. Most of the application's options remain a mystery to us.

A completely non-obvious button for adding funds to the budget, hidden in general list expenses - look for a plastic card with the signature “Salary”.

m8 - my money. My way

The main feature of this application is the visualization of expenses in the form of two columns. Having indicated your quarterly income and daily expenses, you will see a scale of expenses in the right column, and the cash balance in the left column. The second feature of the application that the developers are proud of: when you reach a certain threshold of your cash reserves, the smiley face, serenely floating above, will gradually begin to become sad until it finally frowns - this will be a signal that it’s time to get off the couch and go earn some more money.

Good visualization of expenses, clearly showing the state of affairs in your wallet.

By clicking on the emoji, you can see how your financial affairs are: very good, good, good or bad - the developers call this the current status.

If desired, you can change the emotions of the emoticon and the names of the stages. For example, the emoticon will smile even despite your bankruptcy.

After adding new line expenses, it automatically joins a cloud of tags that pop up every time you type it. If desired, they can be deleted in the settings.

Expenses can be recorded for the future or after the fact.

The general chart does not display the types of your income and expenses - to access them you need to make one extra move.

Money Care

An application for meticulous accountants and simply big money lovers who are ready, like Scrooge McDuck, to recalculate their income every free minute. If you are not afraid to sacrifice your time and convenience for the sake of accurate expense tracking, then this application will definitely take its rightful place in your phone. For all its unprepossessing and outward unfriendliness, Money Care has rich functionality that allows you to take into account a bunch of different little things: look at graphs of your expenses, divide expenses among several people, and so on.

To prevent your records from being lost, the application provides the ability to send backup copy file to email, Dropbox or Google Drive.

A hint system is provided for beginners. But even figuring it out the first time is not so easy.

All transactions can be divided into several accounts. This feature is especially useful for families with a shared budget.

You always have three indicators at hand: receipts, expenses and balance.

All information about your income and expenses can be exported to Excel and sent by mail.

You will be allowed to make no more than 50 entries for free, and for the unlimited version you will have to pay 99 rubles.

The process of adding income and expenses is too complex and long: enter the name of the transaction - confirm, add the amount - confirm, do not forget to assign a category - confirm, and then confirm the entire operation again.

Very small menu elements - to get to the right buttons you need to have very thin fingers.

Daily Budget

The perfect app for consumers suffering from daily shopping syndrome, which is the rest of us. If you want to start saving money for something more meaningful than lunch, this app will help you take control and calculate your daily expenses. To begin the cost containment exercise, you need to enter your monthly income, indicate the amount of standard monthly expenses (for example, utility bills) and indicate the percentage of your total income that you want to save in the piggy bank. After a little thought, the application will give you an amount that you can safely spend during the day.

To prevent you from being fooled, the app provides reminders to enter expenses.

For each expense, you can add a comment that justifies your extravagance.

Moni

The most unpleasant feature of income is that it quickly turns into expenses, threatening to leave you without money at the most inopportune moment. To prevent this from happening so quickly, you can make a vow to yourself to only earn money without buying anything, or you can simply keep track of your expenses. Thanks to Moni, your cash will always be visible to you, all you need to do is meticulously mark each purchase.

If you live among thieves and hypocrites, then the application can be protected with a PIN code. Four identical numbers are not accepted as a precaution.

There are tips for beginners.

There are no fancy icons, colors or other visualizations for different types of expenses.

Programs for maintaining, accounting and planning a family budget, are reliable assistants for effective management of the family budget. Why? Because they allow you to automate many processes, which greatly simplifies the process of maintaining home finance.

In addition, this software has a lot auxiliary functions, which allow you to identify the strengths and weaknesses of your relationship with money, will open your eyes to seemingly obvious things, but for some reason not used in everyday life. Programs for maintaining a family budget greatly facilitate and help create a holistic picture of our relationship with finances.

Purpose of the review

- Determine from the variety of specialized software the best price-quality ratio;

- Select the most optimal and easy-to-use program for maintaining a family budget;

- Determine the main characteristics of the proposed programs for maintaining a family budget;

- Identify the simplest and most understandable solutions for beginners, as well as select more serious and complex products for advanced users;

- Determine the degree of convenience in working with each program;

- Select the most pleasant design and management software;

Criteria for evaluation

I will evaluate all programs for managing a family budget according to five main criteria:

- Simple and intuitive interface;

- Ease of use;

- Functionality;

- Family budget planning;

- Reports and analysis.

Why exactly according to these criteria? Because these are the cornerstones of any special software for accounting and planning a family budget. Many programs today have much more complex capabilities. But they are needed only if the utility suits the criteria listed above.

If the product is difficult to learn or difficult to use on a daily basis, then the user will not need all the bells and whistles that the developers have stuffed into their product.

What programs for managing a family budget will be reviewed?

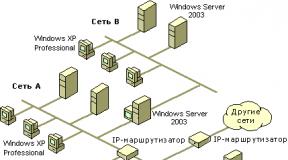

| NAME | DEVELOPER | WEBSITE |

| Greedy | AmoSoft | http://www.amosoft.net/ |

| Home Finance | Lab-1M | http://www.lab-1m.ru/ |

| Home accounting | Keepsoft | http://www.keepsoft.ru/homebuh.htm |

| Home Economics | AMS Software | http://home-economy.ru/ |

| Family budget | Nemtsev A.S. | http://www.familybudget.ru/ |

| Money Tracker | DominSoft | http://www.dominsoft.ru/ |

| Ace Money | MechCAD | http://www.mechcad.net/index_r.shtml |

| Family 2009 | Sanuel | http://www.sanuel.com/ru/family/ |

Today, these are one of the most popular programs for maintaining a family budget on a computer. I do not take into account online services for keeping track of personal finances online. In the future, I plan to regularly monitor new products and add reviews of them to my blog.

What the review will look like

I decided not to do a general review of all the programs, since it would be too large and inconvenient to understand. Therefore, a separate report will be prepared for each program, with screenshots. In the blog, I will create a special section called “Software”. In this section, you can familiarize yourself with the list of reviewed programs. There will also be a link to detailed review for each product and the cost is indicated.

The final stage will be the publication of a brief report on all programs, and a table with assessments of the main parameters of the program will be posted. There will also be an overall score below, based on which you can understand which product, in my opinion, deserves the highest ratings.